Balancing social responsibilities with financial ones

In May, I had the pleasure of attending Utility Week Live, where I was part of a roundtable discussing vulnerable customers and the role that utilities play in their well-being, including financial attributes. The discussion, attended by leaders from energy, water and distribution companies, mostly reflected on the very human stories of people in arrears or without the means to pay their bills.

A survey by the UK Office of Gas and Electricity Markets finds an increasing trend in consumers cancelling their direct debits. Many consumers are forced to decide between heating or eating, and a large number are forgoing eating more than three times a week.

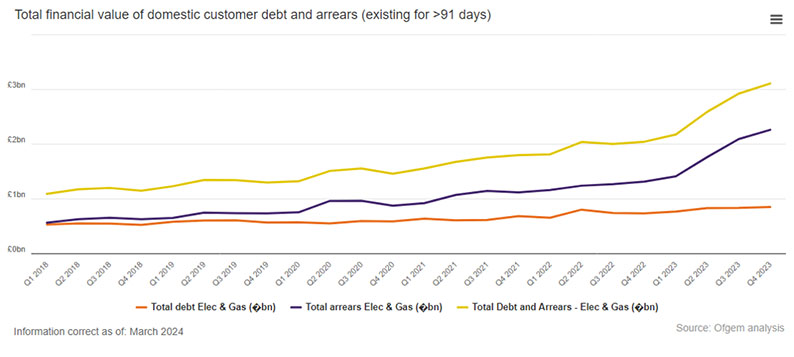

On the other side of this discussion is the ever-increasing challenge of debt books that have grown by tenfold over the last five years.

The UK’s national energy debt book has exceeded £3bn

A continuum of need

Consumers have different requirements for support when their ability to pay shifts. Technology can play its part in proactively detecting those who are most vulnerable, or are fuel-poor, and who may end up in arrears. It can help those in need to avoid large and unexpected bills. We’ve identified three key situations:

- In arrears – How do we compassionately and respectively restore the want and means to pay?

- Changing financial needs – How do we detect shifting needs and proactively prevent arrears?

- Changing payment habits – How do we encourage regular payment and keeping ahead of dues where direct debit has been turned off?

Common to each of the above scenarios is the issue of trust and engagement. This is a tough ask for an industry with all-time low Net Promoter Scores and engagement according to Ofgem.

The need to be human; really hearing the customer is paramount. Recognizing the stigma and shame that many consumers feel during times of crisis fundamentally affects how they behave and respond to their utility company.

Most importantly, utility companies need to afford consumers the time, space and technological capability to change their payment habits. The change can stay within parameters that work for both parties in a way that they both understand and feel comfortable with.

Enabling technology and disruption to create successful innovative collections norms

At Eviden, we believe enabling technology and a disruptive mindset is at the epicenter of change to face off this huge energy and human crisis.

Within the collections mix, a new and empowering payment method is emerging that suits the needs of both consumers and utility companies. It’s the result of bringing together open banking, artificial intelligence (AI), machine learning (ML) and analytics, built on the rigorous foundation of an immutable ledger.

The benefits of grabbing this new technological opportunity are:

- Better understanding of consumer financial needs – Open banking enables greater understanding of a consumer’s financial standing.

With the consumer’s consent, a utility company is far more able to understand income, outgoings and essential billing. For those in arrears, this is especially helpful in building payment plans and beginning the process of changing and improving payment habits.

This is a more efficient approach. The utility can get an immediate view of consumer finances without the fatiguing and time-consuming task of an anxious consumer filling in vast, complicated and intrusive forms.

Helping consumers manage their finances relieves them of the burden, is kinder and is more likely to lead to a better outcome for both parties.

- Better understanding of ability to pay – Again, with the consumer’s consent, a utility company can see the changing financial needs of their customer over time, allowing the utility to take proactive action and protect the interests of their customer.

Understanding the income and outgoings in near real time allows utilities to proactively spot consumers who might creep into hardship or are vulnerable for some reason. It allows utilities to tailor solutions to the changing needs of an individual or household, offering up grants such as ECO4 (Energy Company Obligation – an energy-efficiency program for the fuel-poor), pathways to third sector or benefits, hardship support, and help from within the utility to suit the customer’s actual situation at any given moment.

Decisions about when to offer hardship support can be informed on an actual financial situation. If a utility can spot those whose lifestyle, rather than income, is the issue, it can accurately triage and direct consumers to the right support.

- Better understanding of frequency of payment – Putting in place payment strategies that better suit the needs of the consumer than direct debit can.

While direct debit is a convenient collection medium for the utility, it is often very tricky for a consumer. Many find it difficult to make a single payment from a single payment source on a single day each month. To put this into context:

-

- Many consumers are paid fortnightly or weekly because of the gig economy.

- Many consumers have multiple payment sources, and frequently move sums of money from one to the other to meet their needs.

- Many have zero-hours contracts, resulting in varying income and outgoing profiles limiting their ability to ensure appropriate funds are available for the direct debit transaction.

Usually, if a customer can’t make a direct debit payment, their only option is to cancel. Direct debit is a blunt tool, with its only management capability being to pay or cancel. The other alternatives are standard credit and pay-as-you-go meters. Standard credit is hugely expensive and hard to reconcile for the utility. And pay-as-you-go meters are particularly intrusive and often more expensive than other pricing structures.

AI/ML and analytics play a huge role in these situations. Imagine a world where utilities build accurate and timely insight around a consumer’s ability to pay and tailor payment frequency to when payment is most appropriate and most likely to succeed, all with the consumer’s consent. Payments are more likely to be made and kept up to date, and the consumer’s finances are optimally managed.

In this world, technology could recommend and encourage a consumer to make some or all of a payment to stay ahead of dues. This could be:

-

- From one or more funding sources

- At one or many times per month

This smooths the dues into flexible, affordable and manageable amounts. Over time, this creates regular payment habits, and builds or reinforces the acknowledgement that bill payments are important and must be made.

As a package, this kind of intelligent technological solution prevents consumers from getting into trouble or arrears in the first place, and positively changes the dynamic of trust with the utility.

- Better understanding leading to better outcomes – Many consumers have elected to turn off direct debit and have chosen to wait for quarterly statements.

There is huge variance quarter to quarter in size of bills across the seasons. This causes several key issues:

-

- Increased risk of the customer’s inability to pay large dues.

- Reduced cash to book of the utility.

Utilities can change the relationship with the consumer by automatically recommending payment when the consumer has the means to pay. This will drive positive changes to payment habits when direct debit is turned off.

Utilities can enable better financial management by helping customers spot when and where they have surplus balance within their bank accounts and encouraging them to make payment. Consumers consent to amounts they can afford and make a series of flexible payments between billing cycles.

As customers are in control, they’re more likely to pay by making regular smaller payments. The utilities see cash to bank earlier than the 90- or 120-day cycles seen in quarterly billing.

While a utility’s debt book is kept down, its relationship with its customer is improved.

Additional benefits of this emerging payment tech

There are other benefits to utilities beyond the obvious financial ones:

- Instant bank-to-bank transfer of payment (cash to bank) – increasing liquidity and boosting cash flow

- Lower transaction cost compared to other collections options such as credit cards

- Automatic reconciliation to account and ledger

- Split and share payments, with automatic reconciliation

- More accurate consumer insights to better plan pricing, product and policy strategies

- Proactive spotting of customers who will possibly enter hardship or are in hardship, with automated triage into the right support teams and support methods

- Easier regulatory reporting than ever before

Time to disrupt the cost-of-living crisis

At Eviden, we have thought long and hard about this wide-reaching social and business challenge. There is a truly disruptive alternative to direct debit. It’s a new way to take multiple flexible payments, from one or more funding sources, at frequencies that suit the consumer; ultimately increasing the likelihood that they’ll pay.

Balancing social responsibility with financial probity

Eviden Flexible Payments provides not only a compassionate way to shift unhealthy payment behavior but also has a clear strategy to reduce the vast debt books that exist in utilities today. We partner with FCA-regulated fintech expert, Ordo; and ByzGen, which provides the open banking and immutable ledger capabilities.

Check out Eviden Flexible Payments here.