Industry 4.0 : Striking a balance between efficiency and innovation

According to a Roland Berger study, NextGen production | How to build a successful digital factory, 2021, in the past, the focus of Industry 4.0 and digitalization projects has been on improving operational excellence, for instance process improvement and cost reduction. Other potential such as the creation of innovative products and new business models remained almost unused.

Although the companies who participated in the study showed willingness to continue investing in digitalization, the focus is not on a shift towards product and business innovations. Whether this is the right path remains to be seen.

To prevent misunderstandings, it is necessary to become operationally more effective and efficient to remain cost competitive. However, there are limits to operational optimization, with cost savings diminishing over time. Neglecting product and service innovation will not be the right strategy for survival in the long term. Therefore, differentiation from competition by promoting innovation using digitalization is becoming increasingly important, with Industry 4.0 technology supporting and enabling this process.

Revolutionizing business models for Industry 4.0

New business models are emerging in the equipment industry to leverage Industry 4.0 in manufacturing. These range from changes in pricing models, like moving away from the traditional sales model of down payment, interim payment, and final payment upon equipment acceptance to a pay-per-use or availability-based pricing model.

With pay-per-use, payment for the machine or system only occurs after the customer has put it into operation, i.e., an amount previously agreed between the customer and supplier is paid for each part or component produced by the machine or system. In the availability-based pricing model, the supplier is paid based on an increase in productivity or availability compared to the previous system. For example, the supplier guarantees an increase in system availability of 3 percentage points and receives a previously contractually agreed bonus until the system price is reached. In all these models, the supplier must pay in advance, which signifies a major change in order financing.

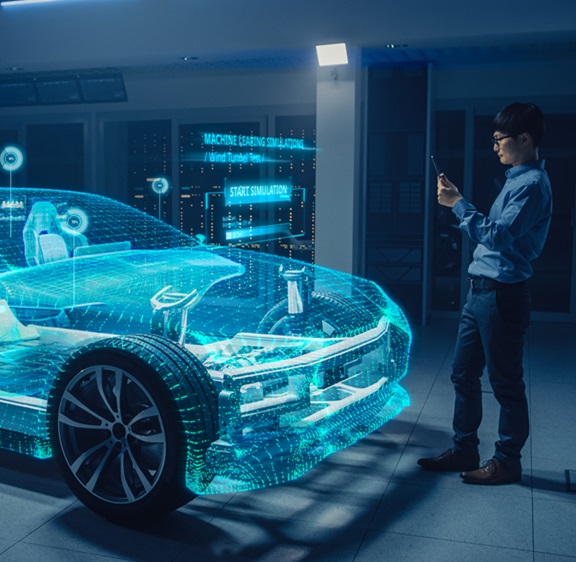

The operator model represents an even more substantial change for the industrial equipment supplier. This means that the supplier operates a specific trade for his customer (e.g., the pressing plant, shell construction, painting or assembly). This trend is especially noticeable in the automotive industry where car manufacturers are increasingly purchasing entire trades. For instance, paint shop manufacturers could find themselves in a situation where the original equipment manufacturer (OEM) requests them to operate the entire paint shop in their factory that they had previously delivered. In this scenario, payment is no longer based on the painting systems, but rather on the painted vehicle. The supplier becomes the painting contractor. Therefore, the system is no longer the focus but rather a means to an end.

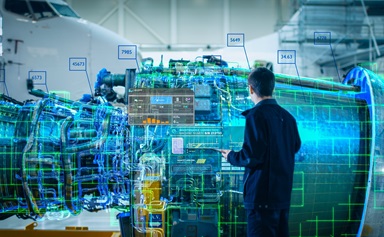

Such new business models require digital services, data exchange between various parties involved in value creation across company boundaries, and security to avoid any intrusion from third parties. Here, the data exchange between customer and supplier regarding plants and machines is becoming increasingly important. For the supplier, access to performance data in the field is valuable to obtain inputs on how to improve their products. Moreover, it enables the supplier to offer additional services such as predictive maintenance.

It’s a win for both parties. The supplier will embrace new sources of revenue and its customer can increase the availability of his equipment by avoiding unplanned stops and incidents.

Government-driven initiatives such as Factory-X focused on discrete manufacturing industry in Germany have recognized that simply supplying highly productive and reliable machines, systems, or components will no longer be a sufficient differentiating feature and the basis for success of industrial equipment suppliers in the future. They will have to place their products in the context of their use, and thus offer solutions for their customers.

There is a paradigm moving away from product focus to benefit-based added value, known as product service systems

Shifting focus: Product optimization to embedded services

The benefits of Industry 4.0 offerings, including AI/ML or data analytics and integration, will provide the basis for the realization of value additions. To maintain competitiveness, it is time to change the enterprises’ focus from optimizing production processes (and the physical product) to creating services that embed the product as a component.

Data-driven services will enable subscription-based business models in the “as-a-service” economy, which can massively increase customer loyalty and thus strengthen the sensitive customer interface.